RENTERS VS. OWNERS – By The Numbers

Jul 22, 2022

WHY EACH RATE HIKE EQUALS MORE PAIN FOR CANADIANS

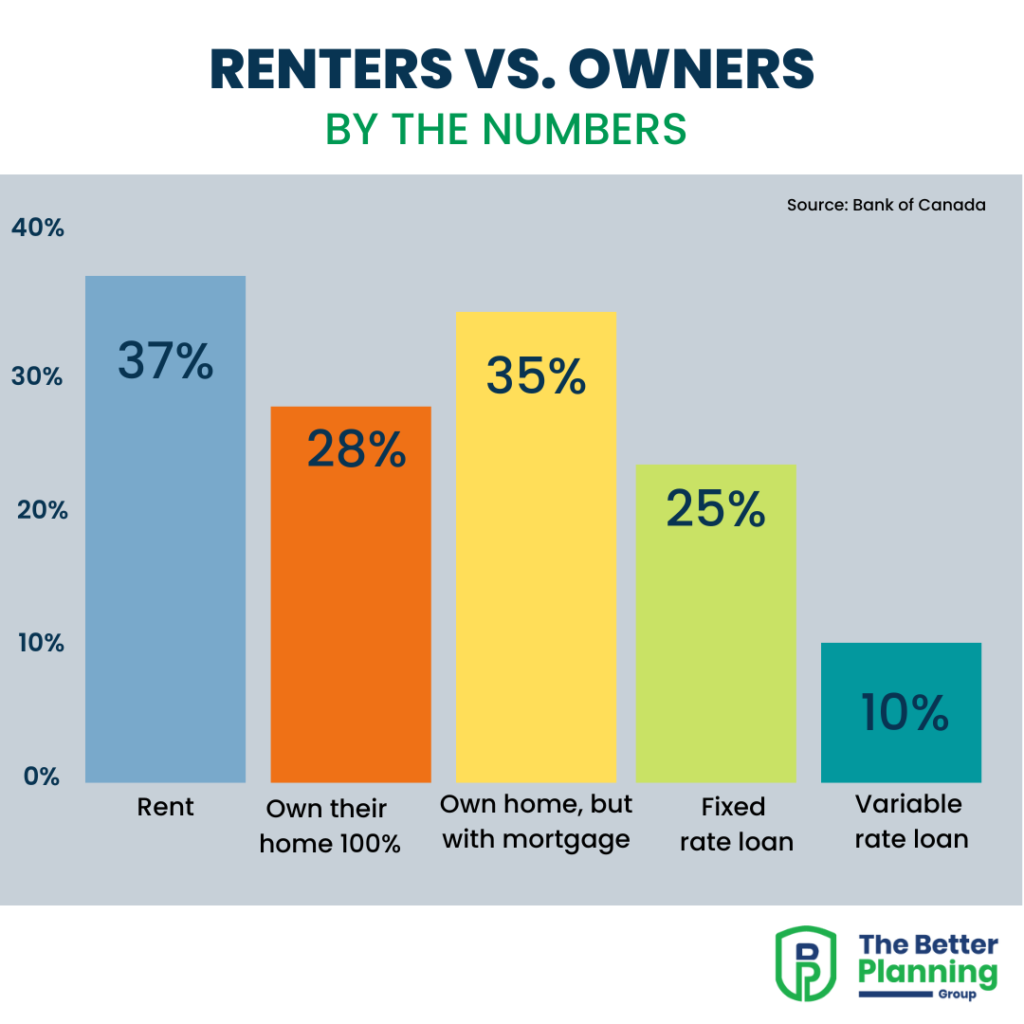

Roughly 2/3 of Canadians are homeowners, and about half of them own their homes outright while the remaining have some sort of mortgage debt attached to it.

During the pandemic home prices increased by about 50% on average, due to low-interest rates. However, the inflated home prices were built on the foundation of debt.

As a result, 1 in 5 Canadian households is considered “highly indebted”, which means their debt-to-income ratio was 350% or more. Prior to the pandemic, this number was only 1 in 6. Barely 20 years ago, in 1999, only one out of every 14 households had that much debt (Desjardins economist Royce Mendes)